| Laka | inshared | unive | Centraal Beheer | Fietszeker | Kingpolis | |

|---|---|---|---|---|---|---|

|

|

|

|  | ||

| | | | | | | |

| from € 2,16 | from € 4,32 | from € 2,34 | from € 2,35 | from € 9,14 | from € 12,26 | |

| View Insurance | View Insurance | View Insurance | View Insurance | View Insurance | View Insurance | |

34% choose | 26% choose | 21% choose | 15% choose | 3% choose | 1% choose | |

| Coverage: | ||||||

| Theft | ||||||

| Damage | ||||||

| Roadside assistance | ||||||

| Global coverage | ||||||

| Legal help | ||||||

| Online account | ||||||

Compensation in case of theft | Full new value | New value up to 3 years | New value up to 3 years | Acquisition value up to 3 years | Unknown | Unknown |

Deductible for theft | No deductible in case of theft. | No deductible in case of theft. | No deductible in case of theft. | € 25 | Dependent on the type of bike | Dependent on the type of bike |

Deductible for damage | No deductible in case of theft. | No deductible in case of theft. | € 50 | € 25 | ||

| View Insurance | View Insurance | View Insurance | View Insurance | View Insurance | View Insurance | |

| | | | | | | |

|

|

|  |

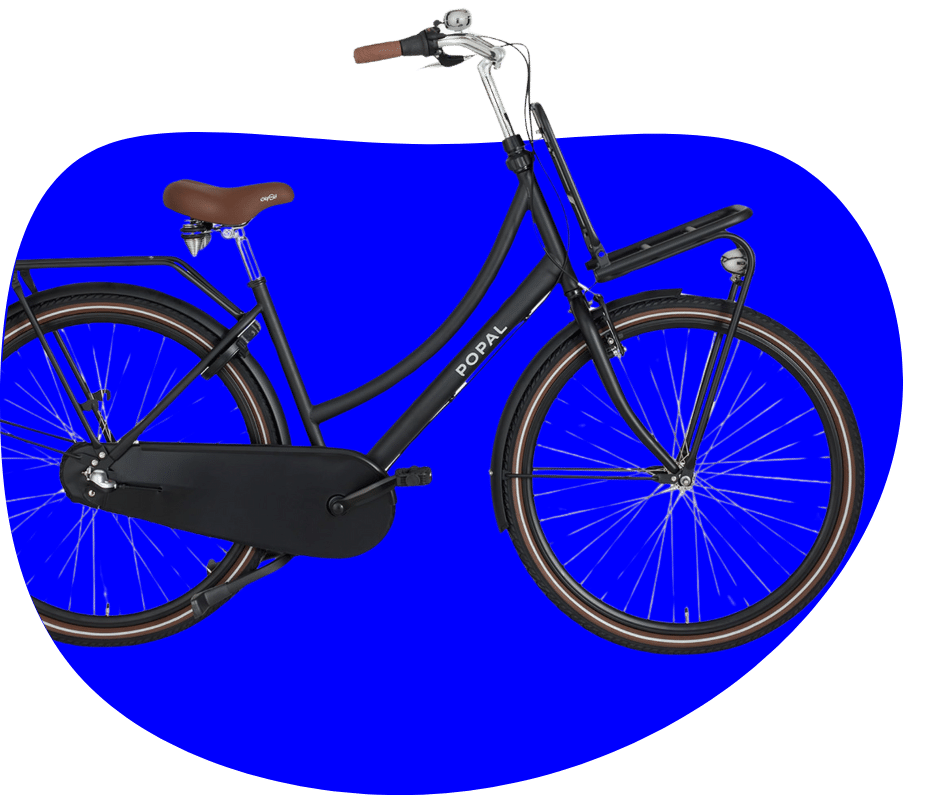

Owning a bike in the Netherlands, whether it’s an electric bike, a city bike, or an expensive bike, is a way of life. However, with the country’s high cycling traffic, the risk of theft or accidents is ever-present. That’s where bicycle insurance becomes essential. From theft insurance to damage insurance, Dutch cyclists can enjoy peace of mind knowing their bikes are fully protected.

That’s why having the right bicycle insurance is essential. Our platform helps you compare the best bicycle insurance plans, so you can find the perfect coverage that fits your needs and budget. Check out the specific terms and conditions on the Dutch insurance companies.

This website is specifically made for all English-speaking people in the Netherlands. For the local Dutch people we have this website in Dutch on Fietsverzekering-Vergelijken.nl.

Bicycles are increasingly popular, especially in the capital cities like Amsterdam. With more bikes on the road, accidents and theft are becoming more common. Bicycle insurance provides financial protection in a variety of situations, including:

Get compensated if your bike is stolen or maliciously damaged. Whether it’s securely parked or on the move, you can ride confidently knowing you’re covered.

Covers damages to your bicycle or injuries resulting from an accident. From minor scrapes to major repairs or medical assistance, you’re protected against unexpected costs.

If you cause injury to someone else or damage their property, this coverage protects you from potentially costly legal fees. It’s a must-have for cycling in busy areas or shared spaces.

In case of serious injury or disability resulting from a cycling accident, this coverage provides financial support to help you recover or adapt to new circumstances.

Receive on-the-spot help if your bike breaks down during a ride. Whether it’s a flat tire, chain issue, or other mechanical problem, we’ll get you back on the road quickly.

Protects against the costs of repairing or replacing your bike after accidental damage. This includes coverage for high-end bicycles or specialized equipment.

An essential part of bicycle insurance in the Netherlands is securing your bicycle. Many insurers require that your bicycle be equipped with an ART-approved lock, usually of ART2 or higher.

This seal guarantees that the lock meets strict security requirements and provides extra protection against theft. It is important to purchase the right type of lock, as a non-approved lock may result in a claim being rejected.

More expensive bikes, such as e-bikes, cargo bikes and speed pedelecs, also often require a track and trace system. This system not only helps track a stolen bike, but also works preventively. Companies such as Fris Netherlands offer specialized solutions that meet the requirements of insurers. In some cases, the track & trace system must be professionally installed and have an active subscription to qualify for full coverage.

By meeting these security requirements, you ensure that your bike is optimally protected and that your insurance company can handle any claims without a hitch.

Laka is completely different. With us, you don’t pay upfront just in case something might go wrong. We’re a collective of optimists who look out for each other—and each other’s bikes.

Your monthly contribution varies. But one thing is certain: you will never pay more than the predetermined maximum amount. If there are no claims in a month, you (and the rest of the collective) pay nothing at all.

Centraal Beheer is here to make sure you can enjoy your bike with confidence. Our bike insurance offers comprehensive coverage against theft, damage, and accidents, so you can ride without worry. Whether you have a regular bike or an e-bike, we provide flexible options to match your needs.

We believe in fair and affordable bike insurance that keeps you covered without breaking the bank. Our insurance protects your bike from theft, damage, and accidents, giving you peace of mind every time you ride. We’re proud to offer transparent policies and easy online services, so you’re always in control.

We’re all about helping you protect the things you value—like your bike. Our bike insurance offers solid coverage against theft and damage, so you can ride with peace of mind.

We focus on providing affordable, straightforward insurance that suits your needs, with no hidden surprises. Our priority is our customers, and we’re committed to offering personal service and reliable support whenever you need us.

Road bikes are designed for speed and distance, often with high-end components and lightweight materials that come with a significant price tag. If you’re clocking miles on your sleek road bike, here’s what to look for in insurance:

Mountain bikes are built tough for off-road terrains, but they’re not immune to the bumps, scrapes, and tumbles that come with the trail. Here’s what you need from an insurance policy for your mountain bike:

Electric bikes, or e-bikes, are growing in popularity for their ease of use and extended range. But with advanced electronics and high-end motors, they also come with a hefty price tag. Here’s what you should look for in e-bike insurance:

Folding bikes are popular for urban dwellers who need a compact and portable option for commuting. While their size may make them easy to store, they still need the right insurance:

Cycling is an essential part of daily life in the Netherlands, and insuring your bike can protect against theft, damage, or accidents. The cost of bike insurance varies based on factors such as the type of bike, coverage options, and the insurance provider. Below is a pricing table from some of the top bike insurance companies in the Netherlands, offering basic theft and damage coverage.

| Insurance Company | Costs per month (Starting price) |

|---|---|

| Laka | € 5,41 |

| Inshared | € 4,32 |

| Univé | € 2,34 |

| Centraal Beheer | € 2,35 |

Prices may vary depending on the bike type and additional options like worldwide coverage or personal accident coverage. Always check with the provider for the most accurate rates.

Filing a bike insurance claim in the Netherlands is a straightforward process designed to help you get back on the road quickly. After an incident, such as theft or damage, it’s important to report the issue to your insurer as soon as possible. Most providers require details like the incident’s date, location, and any supporting evidence, such as photos or police reports.

Submitting an accurate claim ensures a smooth process, allowing you to repair or replace your bike with minimal hassle. With a reliable Dutch bike insurance, navigating unexpected setbacks becomes much easier.

The cost of bike insurance in the Netherlands typically ranges between €2 and €30 per month, depending on factors such as the bike’s value, type (standard or e-bike), and the level of coverage chosen.

While bike insurance is not mandatory in the Netherlands, it is highly recommended, especially for high-value bikes or e-bikes. Additionally, third-party liability insurance is strongly advised to cover potential damages caused to others.

While some homeowners or renters insurance may cover bikes, the coverage is often limited. Bicycle-specific insurance provides broader protection, especially for high-end bikes.

If your bike is stolen, bicycle insurance can help cover the cost of a replacement, depending on your policy’s terms.

No, you do not need insurance to purchase a bike in the Netherlands. However, having insurance is a wise choice to protect against theft, accidents, or damages, ensuring peace of mind as you ride.

Home